Target Net Return

Invest in a portfolio of short-term rentals (AirBnB, VRBO) without the headache of managing them.

Find out More

Why Short Term Rentals?

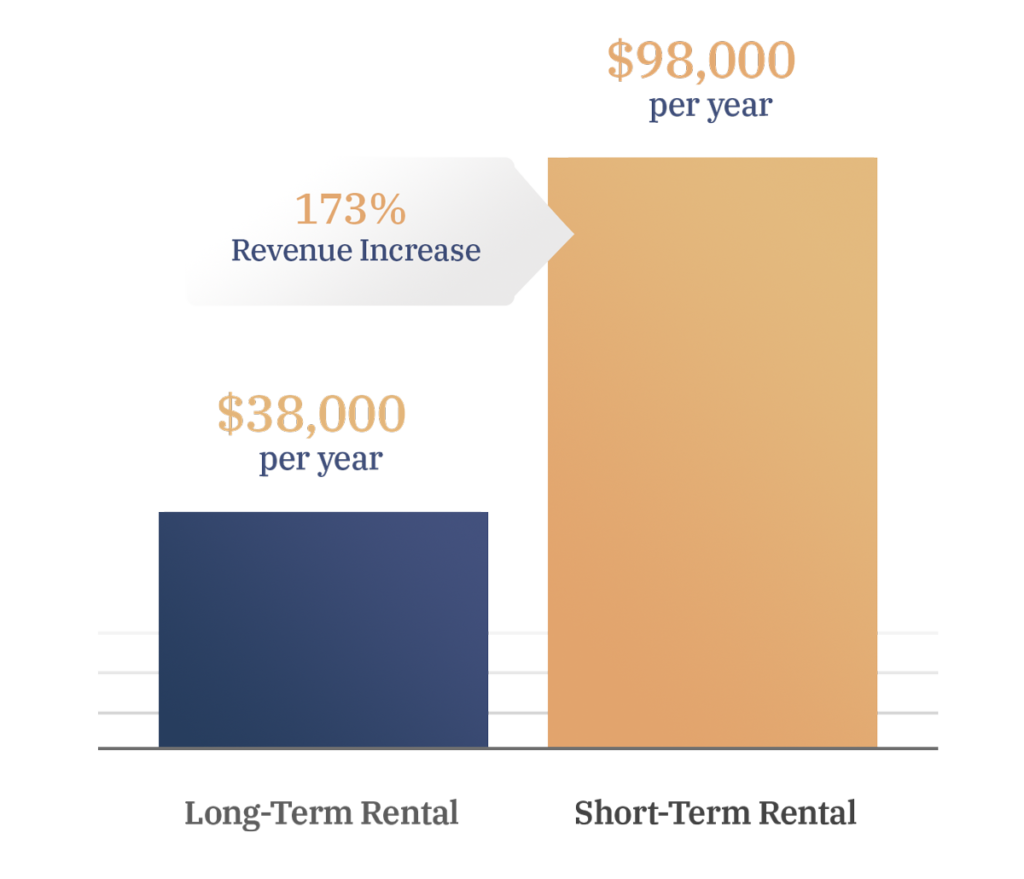

Higher Earning Potential

Nightly rates for short-term are higher than long-term rental units, especially in central locations with amenitized accommodations

Inflation Hedge

Rental rates reset daily based on market conditions and size respective to rental demand.

High-Touch Maintenance

Units are cleaned after each use and maintained to the highest standards, preserving the asset and avoiding “nesting” typical with long-term rentals.

Rental Income

Real Estate Belongs in Your Portfolio

Owning real estate in your portfolio provides several benefits.

Diversification

Adding real estate to your portfolio can protect you from inevitable economic turmoil. Investment properties may increase in value, protecting from losses other investments may take.

Inflation Hedge

Real estate investments are generally considered a protection against inflation, when the costs of goods and services rise, typically so do home values and rents.

Tax Advantages

Real estate offers many tax advantages including deductions of expenses, mortgage interest, etc. Additionally, the IRS allows each asset to realize depreciation which can significantly offset taxable income produced from the property.

Income + Value-Add

The Stallion Growth Fund profits from the growing Texas hospitality industry through a portfolio of carefully curated properties that operate as short-term rentals. With the focus being to acquire properties in highly-trafficked locations near popular attractions, investors can reap the benefits of both cash-flow and appreciation.

As Texas cities continue to be a hub for both leisure and business travelers, the Stallion Growth Fund produces a steady rental cash flow for its investors.

Stallion Growth Fund Overview

Manager: Stallion Capital Management

Commitment: 36 Months

Target Return: 10-12% Annualized

Min. Investment: $100,000

Qualified Plans/IRAs: Yes

Duration: Evergreen/Open-Ended

Investment: Accredited Investors

Leverage: Up to 75%

Assets Under Management: $21,000,000

Properties Owned: 31

Stallion Capital Management is a private investment firm specializing in providing investors with alternative real estate investments via a family of funds. Our Funds provide real estate investors with access to direct real estate investments once available only to institutional-level investors.

Our philosophy is simple: Real estate has an intrinsic and tangible value which makes it a desirable investment with less volatility than other investment vehicles.

Learn More About Stallion Growth Fund.

Download the Stallion Growth Fund Brochure below! Let our team know if you have any questions.

Stallion Capital Management – 10119 Lake Creek Parkway, STE 202 Austin, Texas